With events in the Middle East and Africa boosting oil prices, some economic watchers are beginning to talk about the possibility of stagflation: a period in which both inflation and unemployment are high. Like the 1970s in the U.S., the time of “malaise,” lines at the gas pump, and strong performance of dividend stocks. According to John Schloegel, portfolio manager at CORDA Investment Management, during the stagflation of the 1970s, 70% of the total stock market return for the decade came from dividends, only 30% from price appreciation. Even without that bad brew, dividends pack a punch, he says: Over the longer run 40-45% of total stock returns can be attributed to dividends.

Unlike bonds, which perform badly in times of inflation, companies stand a chance of beating inflation. If the core business thrives, if the business is able to raise its prices faster than inflation, that dividend may even get a hike.

Is This Stagflation?

In an interview with Bloomberg TV and an opinion piece in the Financial Times, PIMCO’s Mohamed El-Erian warned that a slower-growing West needs to be prepared for the impact of that region’s unsettled circumstances:

In the short run, regional developments will be stagflationary for the global economy due to three main factors: First, higher oil prices will increase production costs and act as a tax on consumers. Second, greater precautionary stockpiling around the world will intensify pressures on commodities as a whole, aggravating the impact of demand-supply imbalances and large injections of liquidity. Third, the region will be a smaller market for other countries’ exports.

The Case for Dividends

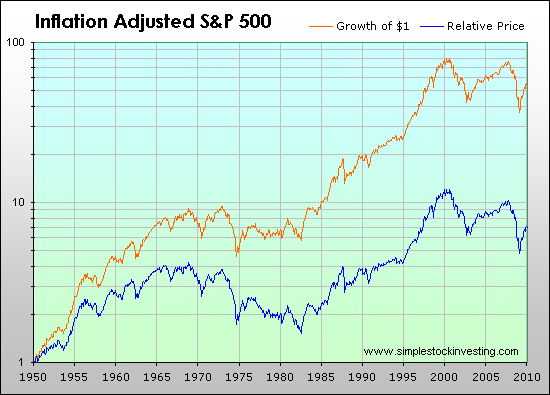

This chart from Simple Stock Investing shows the difference, adjusted for inflation, between what an S&P 500 investor would have earned over the past 60 years if they reinvested every dividend (the orange line) versus what price appreciation alone brought in:

That’s all the more remarkable because the dividend yield of the S&P 500 has been dropping over time, as management seems to prefer stock buy backs (which often generate little shareholder return) and mergers and acquisitions (which are also a crap shoot). Some blame stock-option pay packages for making stock appreciation more valuable to executives than long-term shareholder return. But whatever the reason, overall, the companies of the S&P 500 are offering far less to dividend investors today than they once did. This chart shows how the dividend yield of the S&P 500 companies has dropped since the 1880s.

That doesn’t mean you can’t find companies that are increasing their dividends like the members of the Dividend Aristocrats, which have upped their dividends for 25 years or more. Technology, once a barren land for dividend-focused investors, is increasingly offering dividends and increasing them. In a video interview below, John Schloegel and Bonner Barnes, CORDA’s founder, president and Chief Investment Officer, explain their dividend-focused model. Among their points:

- Dividend contribution to total return in a sideways, meandering market.

- Why dividends could be rising soon given the strong corporate balance sheets at a time of weaker Main Street economics.

- Intel (INTC), Microsoft (MSFT), Cisco (CSCO) and tech dividends.

- Investors’ rising demand for dividends.

- How to evaluate the quality of a dividend.

- The potential danger lurking in especially high yields.

Dividends are always going to be positive, so they are inherently going to play a bigger part in bear markets than they would in bullish times when stock appreciation is carrying the day. They are also more stable. According to a 2008 study by Standard & Poor’s: “over the time period 1989 – September 2008, the standard deviation of annual price returns (in its BMI World Index) is 13.96%. In contrast, the annualized standard deviation of dividend return is 0.27% over the same investment horizon.”

Stock prices move sharply up and down, dividends bump along, whether it’s a time of inflation, stagflation or deflation.